BY SEBASTIAN PAVLOU

Frequently, attention tends to focus on countries at the most fragile end of the Fragile States Index, the inherent assumption being that perhaps those are the only countries we need worry about. But just as important as focusing upon – and actively addressing – the problems besetting countries at the worst end of the Index, note also needs to be taken of countries that, although perhaps finding themselves at the more stable end of the Index, are nevertheless constantly sliding.

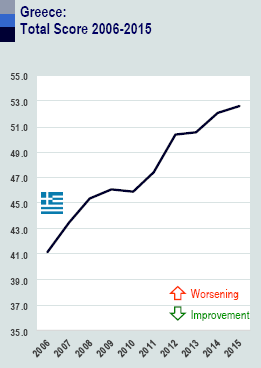

Greece ranks as the 42nd most stable country on this year’s Fragile States Index, having dropped three spots from 2014, registering a slight worsening of 0.5 points in its overall score since last year. While this puts Greece in the 25th percentile of the least fragile states on the Index, a closer look at the areas of decline offers a more accurate portrayal of the current threats to the nation’s stability.

Greece ranks as the 42nd most stable country on this year’s Fragile States Index, having dropped three spots from 2014, registering a slight worsening of 0.5 points in its overall score since last year. While this puts Greece in the 25th percentile of the least fragile states on the Index, a closer look at the areas of decline offers a more accurate portrayal of the current threats to the nation’s stability.

Those indicators where Greece displayed the highest degree of fragility were once again, and by far, State Legitimacy and Economic Decline. This is unsurprising, considering the ongoing government-debt crisis during which Greece has suffered five years of economic austerity and repeated rounds of large-scale protests driven by fierce anti-government sentiment. Greece was one of four European countries that needed to be rescued by sovereign bailout programs, wherein Greece was offered a series of bailout loans based on conditions mandating that in return for a €240 billion bailout and a partial write-down of the debt owed to private creditors, the Greek government would implement a broad range of de-regulation and privatization policies, including selling public assets, cutting social expenditure, reducing labor costs, and raising fiscal revenues.

While the center-left Syriza Party’s victory in the January 2015 snap parliamentary elections temporarily quelled civil unrest, the rising political tension between the Syriza-led government and Greece’s European creditors resulted in the Troika’s suspension of the current bailout program pending negotiations on a new set of payment conditions. The unprecedented nature of these negotiations has renewed international concerns over whether Greece will strike a new deal with European creditors or default on its debts and potentially exit the Eurozone. Meanwhile, the imminent liquidity crisis for both the Greek government and Greek financial system has resulted in plummeting stock prices on the Athens Stock Exchange.

The so-called ‘Greek Depression’ has had substantial, wide-ranging impact in social, political and economic terms. While austerity has helped reduce Greece’s primary deficit, the Greek economy has reportedly contracted by 6 per cent annually in nominal terms and by as much as 10 per cent after adjusting for inflation. GDP has diminished by over 25 per cent and wages have decreased as much as 33 per cent. Unemployment has trebled to 26 per cent and youth unemployment now stands at 50 per cent after peaking at 60 per cent last year. The government still has an outstanding debt of €330 billion and the debt-to-GDP ratio stands at 177 per cent. Between November 2014 and February 2015, Greek bank deposits shrank by nearly 15 per cent of their total value, dropping to a 10-year low. Lower production has led to dismissals and the loss of thousands of jobs, further amplifying the recession.

The so-called ‘Greek Depression’ has had substantial, wide-ranging impact in social, political and economic terms. While austerity has helped reduce Greece’s primary deficit, the Greek economy has reportedly contracted by 6 per cent annually in nominal terms and by as much as 10 per cent after adjusting for inflation. GDP has diminished by over 25 per cent and wages have decreased as much as 33 per cent. Unemployment has trebled to 26 per cent and youth unemployment now stands at 50 per cent after peaking at 60 per cent last year. The government still has an outstanding debt of €330 billion and the debt-to-GDP ratio stands at 177 per cent. Between November 2014 and February 2015, Greek bank deposits shrank by nearly 15 per cent of their total value, dropping to a 10-year low. Lower production has led to dismissals and the loss of thousands of jobs, further amplifying the recession.

In societal terms, the austerity measures implemented in Greece have had dire effects that have by-and-large reinforced the recession’s adverse consequences on income distribution. Pensions have been drastically cut by up to 40 per cent and homelessness has increased by 25 per cent from 2009 to 2011 with the striking phenomenon of a new demographic of recently-homeless people that includes those with medium or higher educations. Suicides have increased since 2011, the most notable spike occurring in 2012 with a 35.5 per cent rise in registered cases. Drug prevention centers and psychiatric clinics have closed down due to budget cuts while public hospital funding has been cut by 25 per cent, further reducing access to health care services. These and many other factors led the international community to label the social situation in Greece a humanitarian crisis.

The past few years have also brought about the most significant upheaval in the Greek political system since the end of the military dictatorship in 1974. The deepening impact of the recession and the austerity measures adopted as part of the emergency rescue packages have created an overwhelming feeling of dissatisfaction and concern among Greek voters. The subsequent fragmentation of the traditional two-party system in Greece opened the door for smaller political parties. Furthermore, socio-economic disparities among EU member states, combined with a loss of national sovereignty (perceived or real), rapid marginalization, and rising immigration rates, has aggravated nationalist sentiments in Greece and paved the way for more radical political parties. Greece now has one of the largest organized neo-Nazi movements in Europe – ‘the Golden Dawn.’ In the 2015 legislative elections the Golden Dawn secured third place in the popular vote.

The past few years have also brought about the most significant upheaval in the Greek political system since the end of the military dictatorship in 1974. The deepening impact of the recession and the austerity measures adopted as part of the emergency rescue packages have created an overwhelming feeling of dissatisfaction and concern among Greek voters. The subsequent fragmentation of the traditional two-party system in Greece opened the door for smaller political parties. Furthermore, socio-economic disparities among EU member states, combined with a loss of national sovereignty (perceived or real), rapid marginalization, and rising immigration rates, has aggravated nationalist sentiments in Greece and paved the way for more radical political parties. Greece now has one of the largest organized neo-Nazi movements in Europe – ‘the Golden Dawn.’ In the 2015 legislative elections the Golden Dawn secured third place in the popular vote.

Looking forward, negotiations over the conditions for Greece’s bailout are most likely to end with some degree of compromise both from the Greek government and lenders. A new deal would probably mean a new iteration of austerity for Greece and undoubtedly reignite public ire and civil unrest.

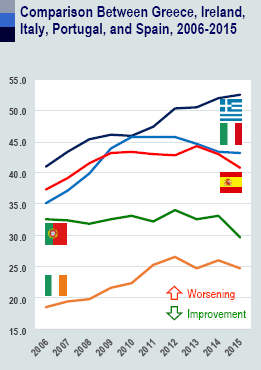

The country’s current state of socio-political volatility and economic uncertainty demonstrates how a nation can rank among the first quartile of least fragile states in the Index, and yet still face critical challenges. Moreover, Greece finds itself at the heart of EU skepticism as member states grapple with asymmetrical recoveries to the 2008 financial crisis.

The fragility of the Greek state remains a crucial issue in the context of the stagnating Eurozone economy, with Greece’s staggering economic decline, political upheaval, and rapid social degradation over the past few years are unparalleled in peacetime Europe.